Education Opens up the Mind

Our training is designed to help estimators create a blueprint for repair and then maximise the use of available estimating systems by teaching them how to navigate the software efficiently, input accurate data, and generate precise estimates. Participants will learn how to optimise the features of these systems to streamline the estimating process, reduce errors, and improve overall productivity. The training also covers best practices for integrating these systems with other tools, ensuring that estimators can produce consistent and professional assessments that align with industry standards.

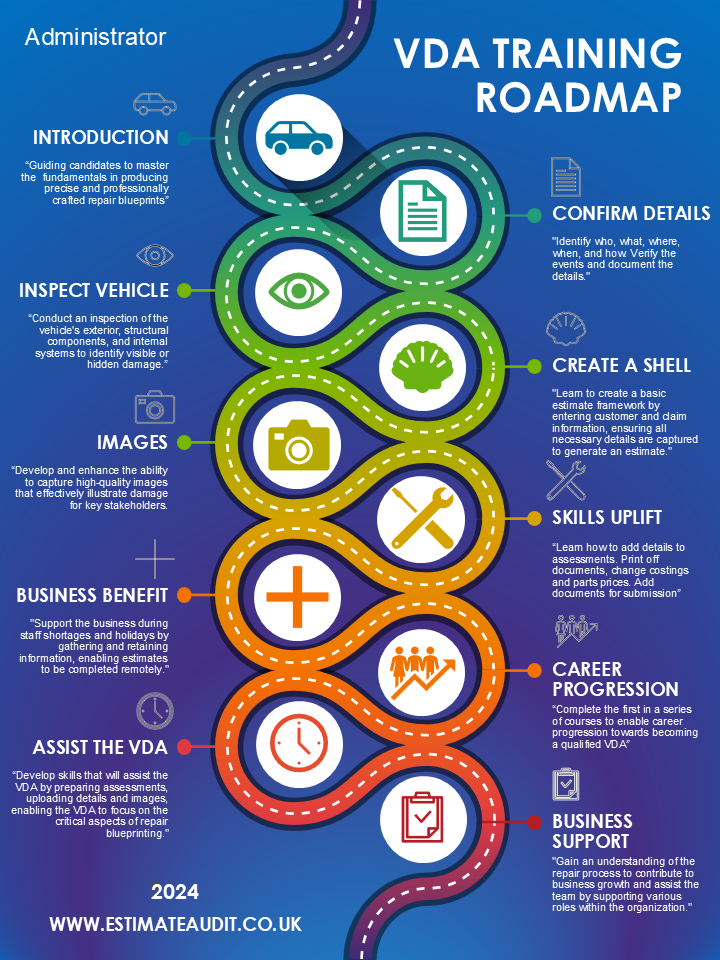

Admin Basic course - Assist the VDA

Our basic course is an introduction to estimating and focus is aimed at the fundamental principles of estimate preparation. Collation of customer details, incident description, dates and images. How to collect information and present it for examination and where to use this information to get the best results.

Syllabus

Our foundational course is designed to equip candidates with the essential skills needed to assist Vehicle Damage Assessors (VDAs) by understanding the basics of data collection, image documentation, and the processes insurers use to authorize repairs.

This training demonstrates that collecting and inputting information can be effectively performed without prior automotive knowledge. By following a structured process, administrators can reduce VDA inefficiencies by up to 70%, allowing VDAs to focus exclusively on creating accurate repair blueprints.

The administrator course is tailored to teach the following skills, aimed at introducing non-technical staff to the repair industry:

- Approaching customers involved in accidents, including key questions to ask and essential information to gather.

- Recording and organising details in an estimate shell for efficient processing.

- Capturing and uploading images of vehicle damage to estimating systems.

- Managing relevant documents such as parts invoices and subcontractor records.

- Taking accurate and comprehensive images, documenting vehicle details, and verifying damage.

- Making minor updates to estimate shells, such as adjusting parts prices.

Course Benefits

Our program provides a structured pathway for candidates to master the fundamentals of estimate preparation, enabling remote damage assessments and significantly reducing the workload on VDA staff.

Additional course content

The seven fundamental principles of insurance are:

- Indemnity

- Subrogation

- Chattel (Insurable Interest)

- Utmost Good Faith

- Proximate Cause

- Loss Minimization

- Betterment or Contribution

Administrator basics course

For New staff not used to creating estimates

-

Understanding the importance of documenting and evidencing damage

-

Recognise the role of images in the estimating process

-

Develop skills to assess damages and identify unrelated ones.

-

Learn to transmit assessments and use Audamails for communication

-

Understand vehicle systems and more

Experienced Estimator Course

Our experienced estimator course assumes that the candidate knows about estimate preparation and seeks to improve on the method of blueprint creation. We delve into the actual method of repair and look at specific methods to determine what is and isn’t included in repair times

Syllabus

Advanced Estimator Course Overview

Our Advanced Estimator Course builds on basic documentation and imaging skills, beginning with a quick recap on imaging techniques to ensure participants are prepared for more advanced concepts. The course focuses on refining estimators’ abilities to accurately assess and plan vehicle repairs, ensuring efficiency and minimizing errors.

Key Topics Covered:

Blueprinting Repairs:

- Learn to create a complete repair blueprint before entering data into the estimating system, covering all aspects of vehicle reinstatement.

Audatex Estimating System:

- Understand what is and isn’t included in Audatex and how to add commonly missed items to ensure accurate repair cost estimates.

Effective Use of Images:

- Discover how detailed images help create precise assessments, minimising supplementary work and delays.

Core Concepts:

- Engineering principles for repair processes.

- Identifying sundry items in Zone 99.

- Repair methodology and its practical application.

- Relevance of the Consumer Rights Act 2015 for compliance and customer satisfaction.

Course Benefits:

- Create precise, error-free repair plans.

- Maximise profitability by identifying missed items.

- Build customer trust through accurate estimates and legal compliance.

This course equips estimators with advanced skills to deliver efficient, professional, and reliable repair assessments.

Additional course content

The Importance of the Consumer Rights Act in Vehicle Damage Assessment for Repairers

The Consumer Rights Act 2015 is a cornerstone of consumer protection in the UK, providing clear rights and expectations for individuals purchasing goods or services. For vehicle repairers, understanding and adhering to this legislation is crucial when assessing and repairing vehicle damage. It not only ensures compliance with the law but also builds trust and credibility with customers.

1. Defining Standards of Service

Under the Act, services provided must meet three key criteria:

- Reasonable care and skill: Repairers are required to use the appropriate level of expertise and professionalism in their work. This ensures that the vehicle is restored to a safe and functional condition.

- Completion within a reasonable time: Customers are entitled to timely repairs. Delays can lead to dissatisfaction and potential claims under the Act.

- Fair charges: The costs associated with the repair must align with the agreed terms or standard industry practices.

By meeting these standards, repairers can establish a professional reputation and minimize disputes.

2. Clarity in Establishing Damage

The Consumer Rights Act highlights the importance of transparency in service delivery. For repairers, this means:

- Providing clear damage assessments: A detailed and accurate diagnosis of the vehicle’s condition helps customers understand the extent of the damage and the required repairs.

- Offering written estimates: Repairers should provide a breakdown of costs to avoid unexpected charges, ensuring the customer is fully informed before proceeding.

This transparency fosters trust and reduces the likelihood of conflicts over repair quality or costs.

3. Consumer Protections for Goods and Repairs

The Act also applies to any parts used during repairs, which must:

- Be of satisfactory quality: Parts should be durable, functional, and free from defects.

- Be fit for purpose: Components must serve the intended purpose effectively, ensuring the vehicle operates safely after repairs.

- Match any description provided: If a part is advertised as genuine or compatible with a specific make and model, it must meet those criteria.

Failure to comply with these standards can lead to liability for the repairer, including refunds, replacements, or further repairs at no additional cost.

4. Handling Disputes

If a customer is dissatisfied with the repairs or parts used, the Act gives them the right to:

- Request a re-do of the repair at no extra cost.

- Seek a price reduction if the issue cannot be rectified.

- Pursue a claim for damages if negligence is evident.

Being aware of these rights helps repairers handle disputes professionally and maintain a positive relationship with their customers.

5. Building Customer Confidence

Adhering to the Consumer Rights Act demonstrates a repairer’s commitment to ethical practices and customer satisfaction. Customers are more likely to trust and recommend repairers who:

- Clearly explain their processes.

- Use quality parts and materials.

- Uphold professional standards in their work.

This trust is vital in an industry where safety and reliability are paramount.

Conclusion

The Consumer Rights Act is not just a legal obligation for vehicle repairers—it is a framework for ensuring quality, transparency, and fairness in all aspects of the repair process. By aligning their practices with the Act, repairers can enhance their reputation, reduce disputes, and deliver a superior service experience for their customers.

Skilled VDA Course

For experienced estimators looking to extend their range of skills

-

Repair blueprinting

-

Audatex core and advanced skills

-

Repair Methodology

-

Estimate maximisation

-

Consumer rights act 2015

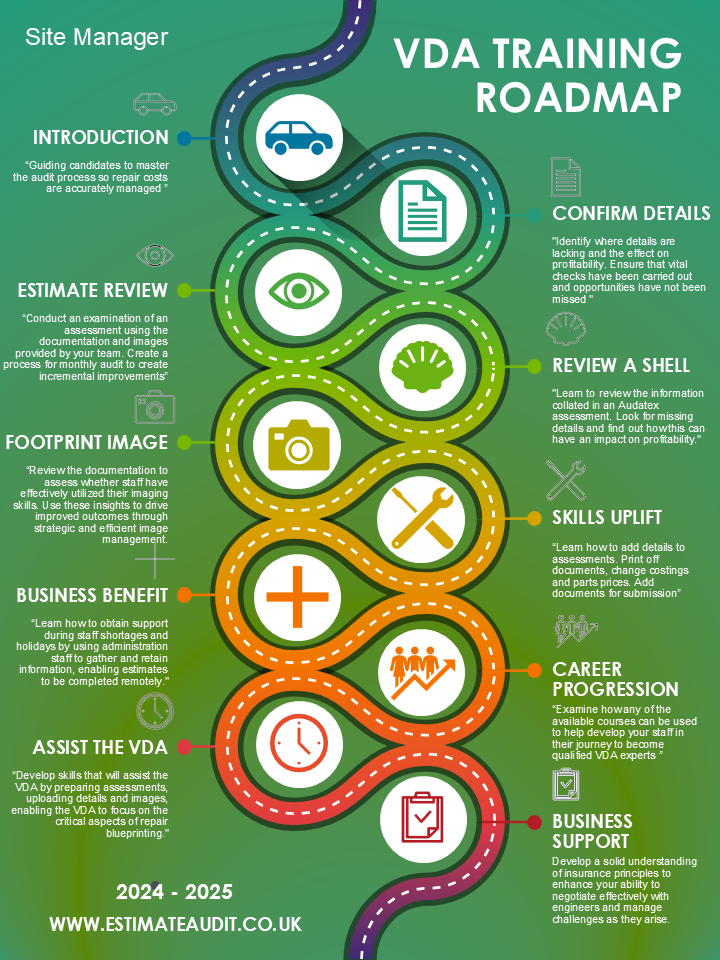

Owner / Director Course

Our Owner-Director course focuses on methods to monitor and evaluate the efficiency of estimators, ensuring that VDAs effectively extract the correct value from available information. Participants are encouraged to use their own real-world data to assess staff performance, with tailored training provided to drive improvements.

Syllabus

Our Owner-Director Course is designed to provide candidates with the tools and skills necessary to thoroughly analyse and improve their operational processes. The course focuses on identifying inefficiencies, maximising opportunities, and protecting profitability, ensuring businesses operate at their highest potential.

Key features of the course include:

In-depth Image and Document Analysis: Learn to evaluate images and documentation effectively, enabling you to identify inefficiencies and opportunities to enhance team performance and reduce profit losses.

Team Development: Gain the skills to train and empower your team to consistently maximise available opportunities while maintaining high standards of accuracy and efficiency.

Mastering Auditing Skills:

- Understand that auditing requires patience and time but is a valuable investment in uncovering hidden issues.

- Learn to identify problems in the repair process that could expose the repairer to scrutiny from third parties, such as insurers or work providers.

Proactive Problem-Solving:

- Develop the ability to spot and address potential issues before they are flagged by work providers or other stakeholders.

- Protect your business from financial and reputational risks by maintaining compliance and staying ahead of potential concerns.

Course Benefits

This course empowers owner-directors to create a culture of accountability, precision, and continuous improvement, ensuring long-term success in a competitive and ever-changing industry.

Additional course content

The training program will cover the responsibilities of insurers and their regulatory requirements. Insurance companies operate under the oversight of the Financial Conduct Authority (FCA) and are legally bound by the provisions of the Financial Services and Markets Act 2000. The FCA enforces numerous “Mandatory Obligations” that insurers must adhere to by law, ensuring compliance with regulatory standards.

Claims Handling Standards (ICOBS 8.1): This section emphasizes the importance of handling claims promptly, fairly, and transparently. It ensures that customers understand the claims process, timelines, and expectations for repair or settlement.

Clear Communication (ICOBS 6A): This requires insurers to provide clear, timely, and easily understood information, ensuring customers are fully informed about repair processes, policy limits, excesses, and potential exclusions.

Policy Coverage Transparency (ICOBS 6.1): This section mandates insurers to clearly outline policy coverage, including repair costs, replacement vehicle provisions, and salvage rights. This helps customers and repairers understand the scope of coverage when assessing vehicle damage.

Fair Treatment of Customers (ICOBS 2.5): This principle ensures that all customers, particularly vulnerable ones, are treated fairly and equitably. In the context of accident-damaged vehicles, this means ensuring reasonable repair solutions and adequate support throughout the claims process.

Third-Party Claims (ICOBS 8.2): This section addresses obligations concerning third-party claims, ensuring these are handled with the same standards of fairness and efficiency as first-party claims, particularly when third-party liability is involved in vehicle damage.

Dispute Resolution and Complaints Handling (ICOBS 8.4): This ensures customers are informed of their rights to escalate disputes to the Financial Ombudsman Service (FOS) or alternative dispute resolution mechanisms when disagreements arise over repair quality or settlement amounts.

Duty to Mitigate Losses (ICOBS 8.1.3): Insurers are required to mitigate losses effectively while ensuring reasonable repair or settlement solutions for customers. This is key when negotiating repair costs or considering total loss settlements.

By adhering to these sections of ICOBS, insurers and repairers can ensure a fair, transparent, and efficient process, benefitting all parties involved in managing accident-damaged vehicles.

The roles and duties of an engineer

- PRIN Principles of business

- Financial services and Markets Act

- Complaints handling Consumer rights act 2015: How to handle complaints within the framework of the consumer rights act to ensure rectification costs are mitigated

- The principle of Estoppel and its importance in contract law.

Manager / Director Course

For managers who want to maximise profits

-

Understand fundamental insurance principles, key concepts, and terminology.

-

Familiarize with the Insurance Conduct of Business Sourcebook (ICOBs) and FCA regulations.

-

Learn strategies for improving communication with insurers and repair professionals.

-

Master the use of digital tools for efficient claims processing

-

Develop skills in using technology to support damage evaluation and documentation

-

Learn how to audit your estimators to ensure they are leveraging the best from available systems and technology